How many real estate brokerages are there?

A basic question that is conceptually quite simple is "How many residential real estate brokerages are there in the United States?" That question is not as easy to answer as one might imagine.

While NAR has monthly data on the number of Realtors and state real estate authorities track the number of real estate licensees, no industry source exists that tracks the number of real estate brokerages on a consistent and ongoing basis.

The only reliable data comes from the U.S. Census Bureau, which tabulates the number of firms and establishments for hundreds of industry sectors across the American economy. While this is the best and only source, it has a two-year lag that limits its usefulness as a timely indicator of changes in the number of real estate brokerages, and, importantly, does not distinguish between residential and commercial real estate brokerages.

However, given that it’s the only data available, the Census gives us something to work with and analyze, even without a guarantee of 100% precision.

About the Census Bureau data

Before providing the actual data, the Census data needs to be explained a bit.

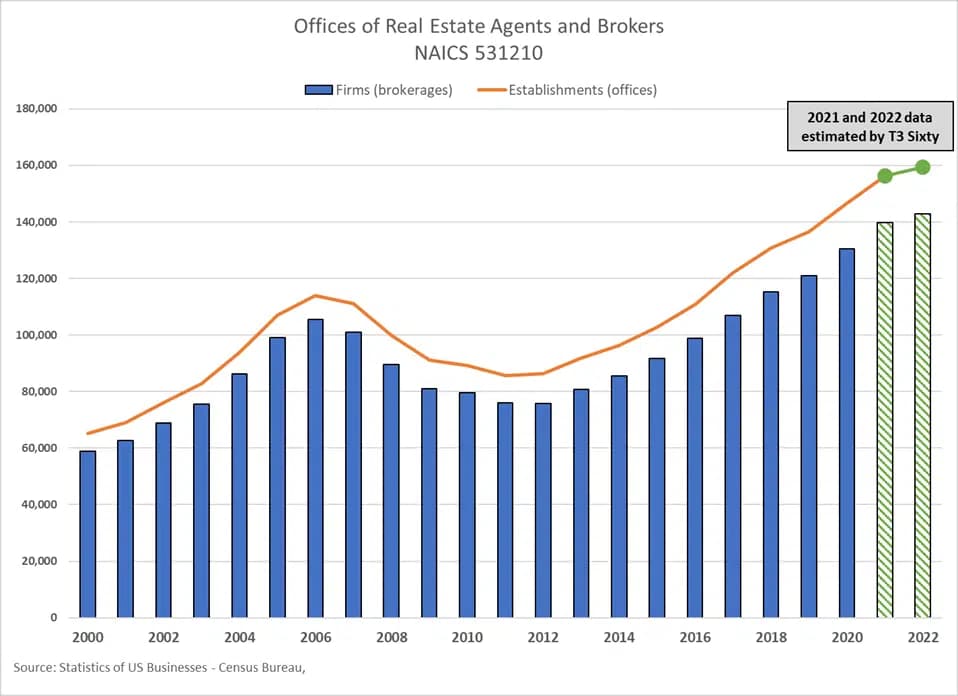

In its brokerage firm data, the Census Bureau makes a distinction between firms and establishments. A firm is the brokerage that may have one or more offices in various locations. The establishment is the individual office in which a brokerage firm has an ownership interest. As a result, there will be at least as many establishments as firms in any industry, including real estate brokerage.

The Census Bureau tracks “Offices of Real Estate Agents and Brokers.” As the Bureau defines it: “This industry comprises establishments primarily engaged in acting as agents and/or brokers in one or more of the following: (1) selling real estate for others; (2) buying real estate for others; and (3) renting real estate for others.”

Note that this definition does not distinguish between residential and commercial brokerage and, in fact, includes both. While there are brokerages that operate exclusively in the commercial real estate brokerage space, and many that are residential only, there are others that engage in both residential and commercial brokerage.

According to NAR's 2021 Profile of Real Estate Firms 81% of firms specialize in residential brokerage and 4% specialize in commercial brokerage. There is, however, a large percentage of firms that conduct both residential and commercial brokerage activities with 34% of firms conducting at least some commercial brokerage transactions and 30% of firms completing residential brokerage transactions even while specializing in other areas.

How many brokerages

Based on the latest available Census data, there were 130,456 firms and 146,621 establishments (offices) counted in the category of "Offices of Real Estate Agents and Brokers" as of 2020. As the chart shows, the number of firms has been on a steady upward climb since reaching a lower point of just under 76,000 in 2012.

Not surprisingly, few brokers contemplated starting a brokerage following the fallout from the financial crisis. In fact, there were roughly 30,000 fewer brokerages by 2012 compared with the previous high of more than 105,000 before that Great Recession and housing crisis emerged.

While the published data is through 2020, further analysis allows us to estimate the number of firms and establishments for 2021 and 2022. The key to making such an estimate is assessing the strong relationship between the number of establishments (offices) and the number of Realtors, for which NAR provides timely data. There is also a close connection between firms and establishments. Over the period between 2000 and 2020, there were roughly 12% more establishments (offices) than firms.

In 2022, the estimated number of real estate brokerages was 142,000, an increase of roughly 68,000 over the past decade. These brokerages accounted for 159,000 offices, which is consistent with data from NAR's firm profile showing that by a wide margin, most brokerage firms have a single office.

Despite the data limitations, tracking the number of brokerages is important for several reasons. The increase or decrease in the number of brokerages is one indicator of the dynamism of the real estate industry and the degree of consolidation that may be occurring. In periods where home sales are rising, entrepreneurial agents start firms to serve a particular clientele or develop new business models to address home buyers' and sellers’ needs in innovative ways.

Even though it is not the timeliest indicator, it is still worth a look to assess recent trends and what they portend for the future.

Takeaway

Looking ahead, we know that the real estate market in the second half of 2022 and into 2023 has hit a rough patch with lower sales and reduced home price growth. Moreover, data from the 2023 Mega 1000 ranking of U.S. brokerages show that roughly three-fourths of ranked brokerages reported a decrease in sales volume compare with 2021. Based on what we know, it would be reasonable to expect at least a modest decline in the number of real estate firms over the next year or two as the fallout from the current market headwinds flows through the real estate industry and pares the ranks of real estate agents.